MSMEs Seek Duty Exemption on ₹8,694 Crore Steel Exports to US

The Indian MSME (Micro, Small, and Medium Enterprises) exporters are seeking duty exemption from the Commerce Ministry on steel goods worth ₹8,694 crore, which are already en route to the US. This move comes in the wake of the new tariffs imposed by the US government on steel imports.

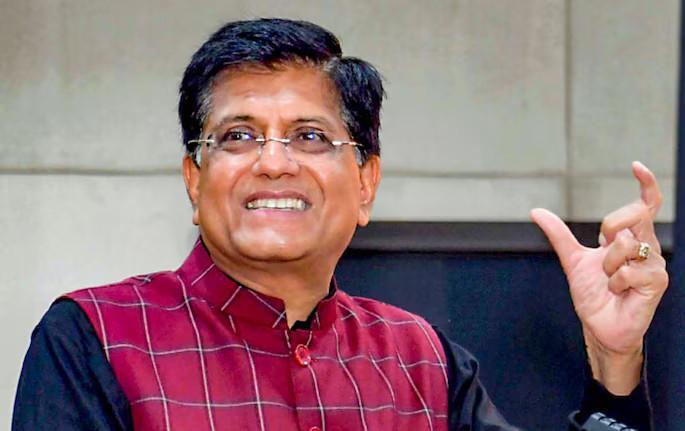

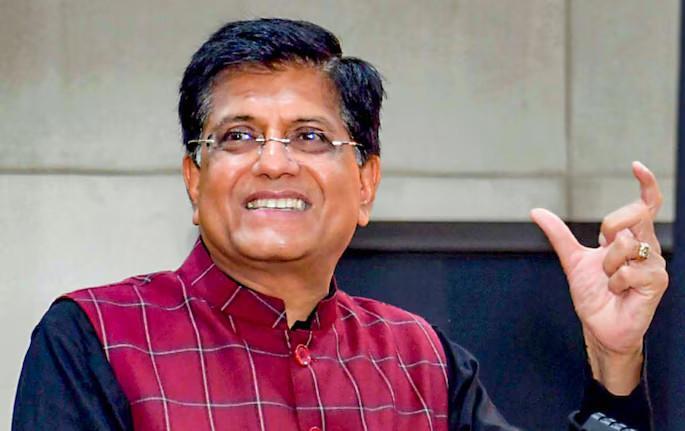

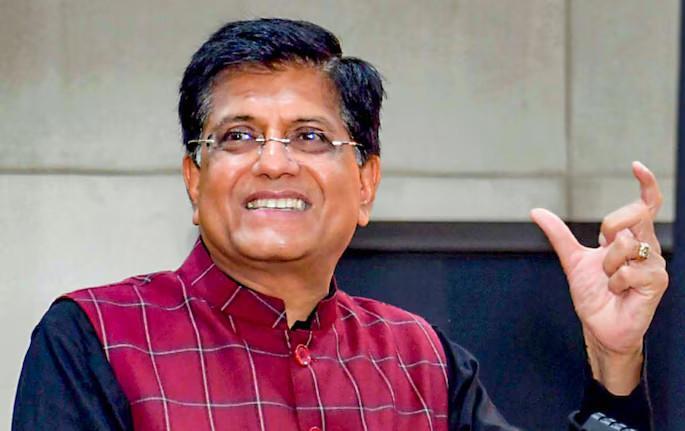

According to sources, a meeting was held recently between the Commerce Minister Piyush Goyal, Commerce Secretary, Director General of Foreign Trade, and representatives from 14 EPCs (Export Promotion Councils) to discuss the impact of the new tariffs on Indian steel exports. During the meeting, the MSME exporters requested the Commerce Ministry to grant duty exemption on the steel goods that are already in transit to the US.

The new tariffs imposed by the US government have created a significant challenge for Indian steel exporters, including the MSME sector. The tariffs, which range from 25% to 30%, have made Indian steel products more expensive and less competitive in the US market. As a result, many Indian steel exporters are facing difficulties in meeting their export commitments and are seeking relief from the government.

The MSME sector is a significant contributor to India’s economy, accounting for around 30% of the country’s GDP and employing over 120 million people. The sector is also a major player in the country’s exports, with a significant share of exports coming from MSMEs.

The steel industry is also a major contributor to the MSME sector, with many MSMEs engaged in the production of steel products such as pipes, tubes, and wires. The industry has been facing significant challenges in recent years, including high raw material costs, power outages, and competition from cheap imports.

The duty exemption sought by MSME exporters is crucial to help them recover their losses and maintain their competitiveness in the global market. The exemption would enable the exporters to reduce their costs and maintain their profit margins, which would help them to continue their exports to the US and other markets.

The Commerce Ministry has taken several measures in recent years to support the MSME sector, including the introduction of the Goods and Services Tax (GST) and the implementation of the Trade Facilitation Agreement (TFA) under the World Trade Organization (WTO). The ministry has also set up the MSME Development Council, which aims to promote the growth and development of the MSME sector.

In addition to the duty exemption, MSME exporters are also seeking other forms of support from the government, including assistance with financing, marketing, and logistics. The government has announced several initiatives to support the MSME sector, including the creation of a dedicated fund to support MSMEs and the establishment of a platform to connect MSMEs with large companies.

The duty exemption sought by MSME exporters is a timely intervention by the government to support the sector, which is facing significant challenges in the current market. The exemption would help MSME exporters to recover their losses and maintain their competitiveness in the global market, which would ultimately benefit the Indian economy.

In conclusion, the MSME exporters are seeking duty exemption on steel goods worth ₹8,694 crore, which are already en route to the US. The exemption is crucial to help MSMEs recover their losses and maintain their competitiveness in the global market. The government has taken several measures to support the MSME sector, and the duty exemption sought by MSME exporters is a timely intervention to support the sector.

News Source: