Stick to Domestic-Focused Businesses to Beat Trump Uncertainty: Nippon’s Bhan

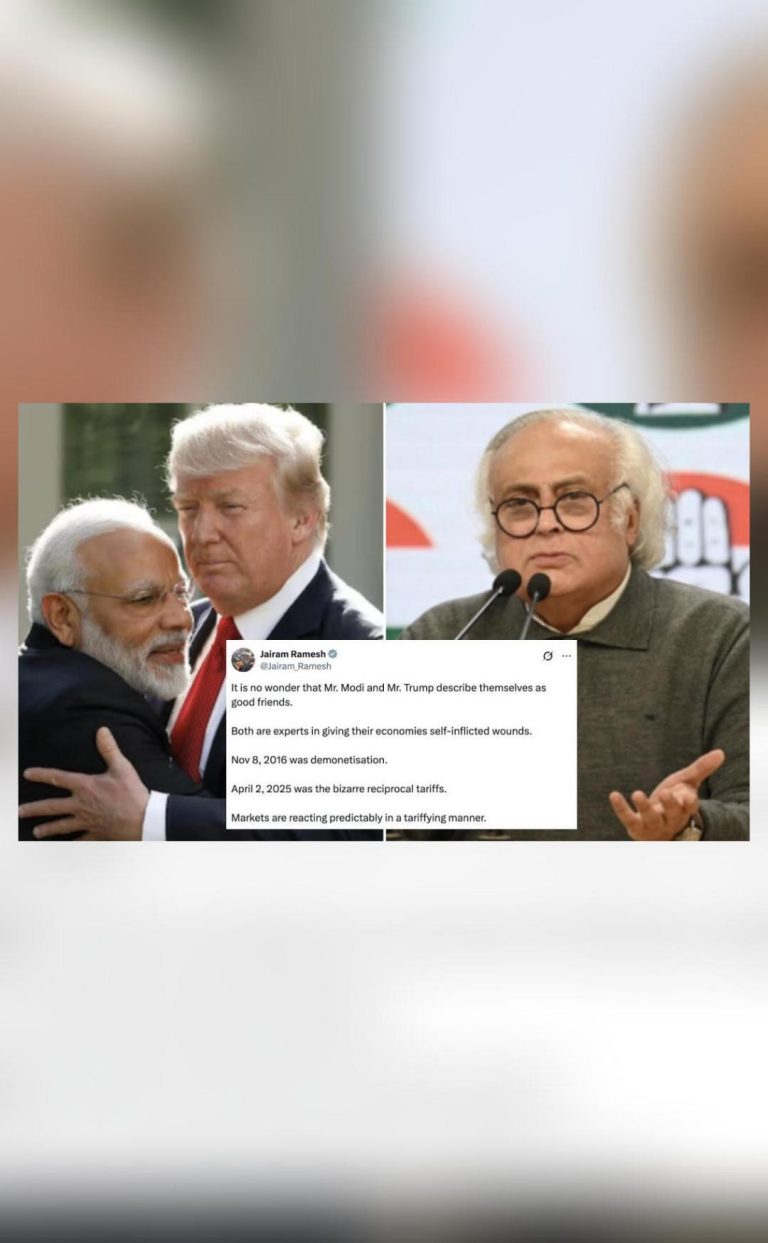

The global economy is facing unprecedented uncertainty due to the trade wars sparked by President Donald Trump’s tariffs on imported goods. While some investors are looking to diversify their portfolios by investing in international stocks, experts are cautioning against this approach. Instead, they are advising investors to focus on domestically driven businesses that are less likely to be affected by trade disruptions.

According to Sailesh Raj Bhan, Chief Investment Officer (CIO) at Nippon India Mutual Fund, investors should prioritize domestic-focused businesses to mitigate the risks associated with Trump’s tariffs. In an interview with Moneycontrol, Bhan emphasized that domestically driven businesses are better placed to weather the storm, as they are less reliant on exports and therefore less vulnerable to tariff-related disruptions.

“If 50% of your business is exports and it sees a 10-15% tariff impact…the earnings hit will not be insignificant,” Bhan warned. This is because a significant portion of the company’s revenue is derived from exports, which are likely to be affected by tariffs. As a result, the earnings of such companies could take a significant hit, making them less attractive to investors.

On the other hand, domestically focused businesses are more insulated from the impact of tariffs, as they derive a smaller proportion of their revenue from exports. This is because their primary customers are domestic consumers, who are less likely to be affected by trade disruptions.

For instance, a company that generates 20% of its revenue from exports may not be as heavily impacted by tariffs as one that derives 50% of its revenue from exports. Similarly, a company that has a strong domestic presence and generates most of its revenue from domestic sales is likely to be less affected by trade disruptions.

Bhan’s advice is particularly relevant in the current market environment, where trade tensions are escalating and tariffs are being imposed on a wide range of imported goods. The uncertainty surrounding the trade wars has led to increased volatility in financial markets, making it essential for investors to adopt a cautious approach.

By focusing on domestically driven businesses, investors can reduce their exposure to trade-related risks and minimize the impact of tariffs on their portfolios. This is not to say that international businesses are not attractive investments, but rather that investors should be selective and prioritize companies with a strong domestic presence.

In addition to the reduced risk, domestically focused businesses often offer other benefits that make them attractive to investors. For instance, they may have a better understanding of local market conditions, allowing them to respond more quickly to changes in consumer preferences and demand. They may also be more agile and better equipped to adapt to changing market conditions, which can be a competitive advantage in a rapidly evolving business environment.

Furthermore, domestically focused businesses are often more resilient in the face of economic downturns, as they are less reliant on exports and therefore less vulnerable to changes in global trade patterns. This is because their primary customers are domestic consumers, who are less likely to be affected by economic downturns. As a result, domestically focused businesses may be better placed to weather economic storms, making them a more attractive investment option for risk-averse investors.

In conclusion, while international businesses can be attractive investments, investors should prioritize domestically focused businesses to mitigate the risks associated with Trump’s tariffs. By doing so, they can reduce their exposure to trade-related risks and minimize the impact of tariffs on their portfolios. Domestically focused businesses often offer other benefits, including a better understanding of local market conditions, greater agility, and resilience in the face of economic downturns.

As investors navigate the uncertain market environment, it is essential to adopt a cautious approach and prioritize investments that are less likely to be affected by trade disruptions. By sticking to domestic-focused businesses, investors can reduce their exposure to trade-related risks and maximize their returns in the long term.