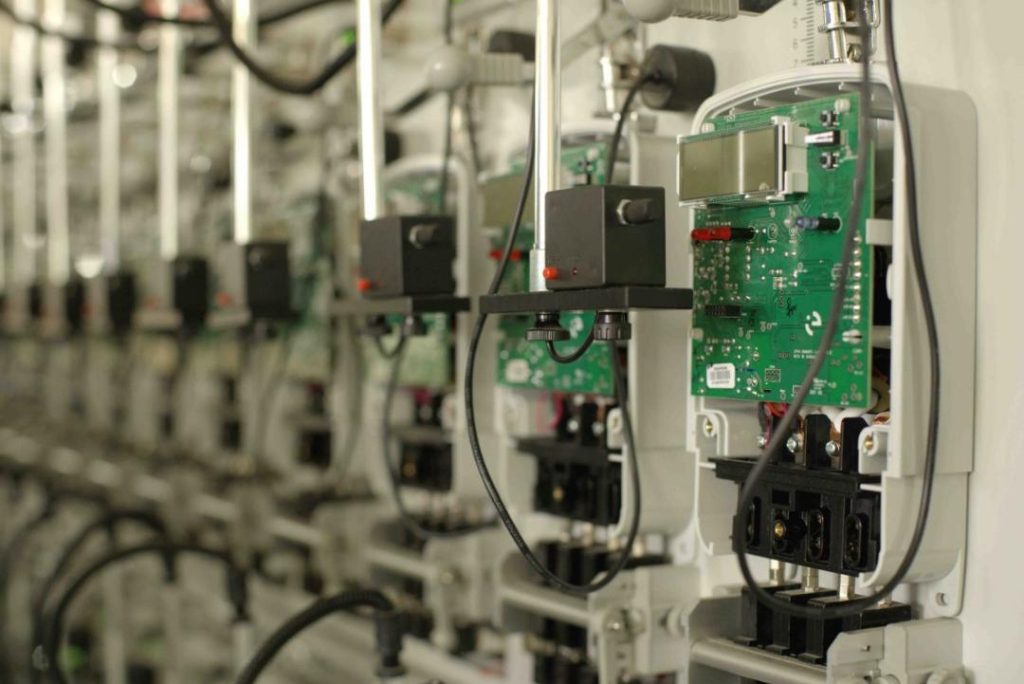

Kaynes Technology Halves Investor Wealth in 2025

The Indian stock market has been witnessing several ups and downs in the past few years, and the latest casualty is Kaynes Technology, a leading electronics maker. The company’s shares have plummeted nearly 50% from around ₹7,600 apiece at the beginning of 2025, wiping off a staggering ₹23,000 crore in market capitalization (m-cap) in just 32 trading sessions.

The sharp decline in Kaynes Technology’s stock price is attributed to the company’s disappointing third-quarter (Q3) earnings, which failed to meet analysts’ expectations. Moreover, the management reduced its revenue guidance for the fiscal year 2025 (FY25), sending shockwaves across the investor community.

The impact of this decline is not limited to the company’s shareholders alone. The broader market has also been affected, with the Nifty 50 index losing around 1.5% in the last one month. The decline in Kaynes Technology’s stock price has led to a significant correction in the overall market, with many analysts and investors taking a cautious approach.

So, what went wrong with Kaynes Technology, and what does the future hold for the company? Let’s delve deeper into the reasons behind the company’s decline and its potential prospects.

Disappointing Q3 Earnings

Kaynes Technology’s Q3 earnings were a major letdown for investors. The company reported a net loss of ₹124 crore, which was significantly higher than the expected profit of ₹100 crore. The disappointing earnings were attributed to several factors, including lower-than-expected revenue growth and higher expenses.

The company’s revenue growth was sluggish, with sequential growth of just 3% in Q3. This was below the expected growth rate of 5-6%, leading to a significant miss in revenue estimates. Additionally, the company’s expenses were higher than expected, which further added to the disappointment.

Reduced FY25 Revenue Guidance

The company’s Q3 earnings miss was followed by a reduction in its FY25 revenue guidance. Kaynes Technology revised its revenue guidance downwards, expecting a growth rate of 10-12% in FY25, which is lower than the expected growth rate of 15-16%.

The reduction in revenue guidance was attributed to several factors, including a slowdown in demand and intense competition in the market. The company’s revenue growth has been impacted by the slowdown in the Indian economy, which has led to a decline in demand for electronic products.

Impact on Investors

The decline in Kaynes Technology’s stock price has had a significant impact on investors. The company’s market capitalization has halved in just a few months, wiping off a significant amount of wealth from investors’ pockets.

The decline in the company’s stock price has also led to a significant correction in the overall market. The Nifty 50 index has lost around 1.5% in the last one month, with many analysts and investors taking a cautious approach.

What’s Next for Kaynes Technology?

Despite the decline in its stock price, Kaynes Technology still has a significant following among analysts. Of the 23 analysts tracking the stock, 17 still maintain a ‘Buy’ on the stock.

The company’s management has indicated that it is working on several initiatives to turn around its fortunes. The company is focusing on cost optimization and is expected to reduce its expenses in the coming quarters.

Additionally, Kaynes Technology is also investing in research and development to improve its product offerings and gain a competitive edge in the market. The company is expected to launch several new products in the coming quarters, which could help improve its revenue growth.

Conclusion

Kaynes Technology’s decline in 2025 is a significant event in the Indian stock market. The company’s disappointing Q3 earnings and reduced FY25 revenue guidance have led to a sharp decline in its stock price, wiping off a significant amount of wealth from investors’ pockets.

Despite the decline, Kaynes Technology still has a significant following among analysts, and the company’s management is working on several initiatives to turn around its fortunes. The company’s focus on cost optimization and investment in research and development could help improve its revenue growth and turn around its fortunes.