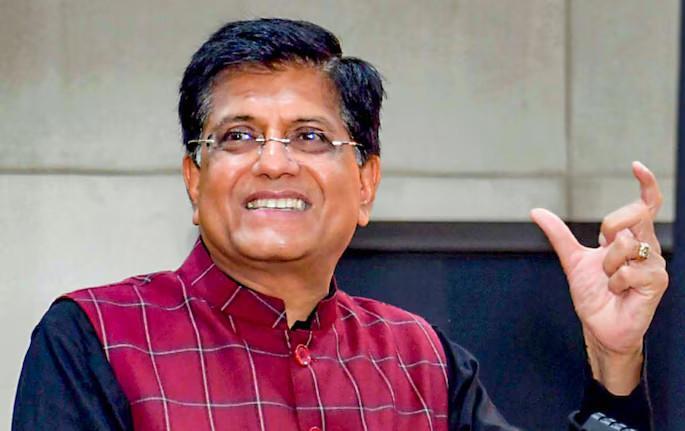

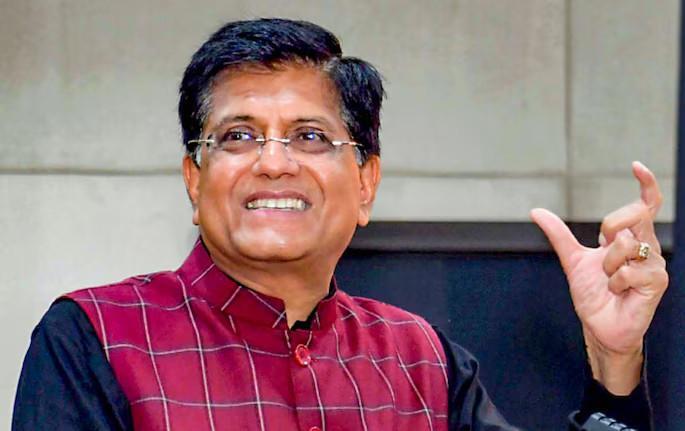

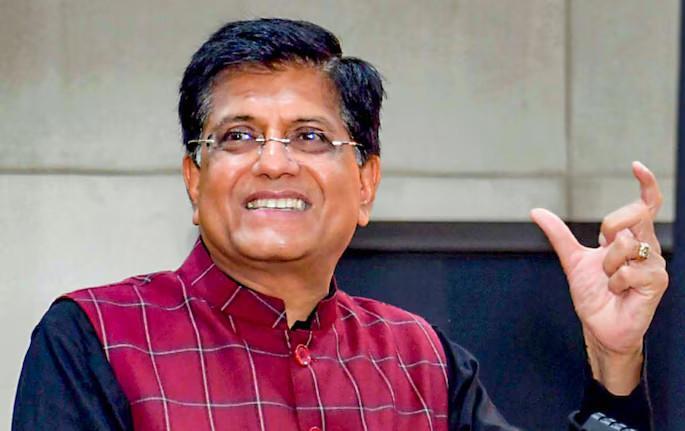

New SEBI Chief Tuhin Pandey Led Sale of Air India, IPO of LIC: A Pioneer in Disinvestment and Financial Restructuring

The Securities and Exchange Board of India (SEBI) has a new chairperson, Tuhin Kanta Pandey, who brings with him a wealth of experience in disinvestment and financial restructuring. As the former Secretary of the Department of Investment and Public Asset Management (DIPAM), Pandey has been instrumental in several major privatisation efforts in the country. One of his most notable achievements is the successful sale of national carrier Air India to the Tata Group for a whopping ₹18,000 crore. Under his supervision, the Life Insurance Corporation (LIC) also made its biggest-ever market debut.

As the new SEBI chief, Pandey’s expertise in disinvestment and financial restructuring is expected to play a crucial role in shaping the country’s financial landscape. In this blog post, we will delve into Pandey’s background, his achievements as DIPAM Secretary, and what we can expect from his tenure as SEBI chief.

Background and Expertise

Tuhin Kanta Pandey is an Indian Administrative Service (IAS) officer who has served in various capacities, including as the Secretary of DIPAM, from 2019 to 2022. Prior to that, he was the Secretary of the Department of Revenue, where he played a key role in implementing the Goods and Services Tax (GST) regime.

Pandey has a strong background in finance and has worked on several high-profile projects, including the disinvestment of state-owned companies. His expertise in financial restructuring and disinvestment has been instrumental in the success of several privatisation efforts in the country.

Sale of Air India to Tata Group

One of Pandey’s most notable achievements as DIPAM Secretary is the successful sale of Air India to the Tata Group. The ₹18,000 crore deal, which was announced in October 2021, marked a significant milestone in the country’s privatisation efforts.

The sale of Air India was a complex process that involved the government’s decision to privatise the national carrier, which was followed by a bidding process involving several interested parties. Pandey played a key role in overseeing the process, which involved negotiations with potential buyers, evaluations of bids, and due diligence checks.

The sale of Air India to the Tata Group was seen as a significant achievement for the government, as it marked the first major privatisation of a state-owned company in over two decades. The deal also marked a significant milestone for the Tata Group, which acquired a valuable asset in the aviation sector.

LIC’s Biggest-Ever Market Debut

Under Pandey’s supervision, LIC also made its biggest-ever market debut in May 2022. The IPO, which raised ₹21,000 crore, was a major success, with the issue being oversubscribed by over 3.3 times.

The LIC IPO was seen as a significant event in the country’s financial markets, as it marked the first-ever listing of a public sector undertaking (PSU) in the insurance sector. The IPO was also seen as a major vote of confidence in the Indian financial markets, as it demonstrated the ability of Indian companies to raise capital from the market.

What to Expect from Pandey’s Tenure as SEBI Chief

As the new SEBI chief, Pandey’s expertise in disinvestment and financial restructuring is expected to play a crucial role in shaping the country’s financial landscape. Here are some areas where we can expect him to make a significant impact:

- Privatisation Efforts: Pandey’s experience in privatisation and disinvestment will be crucial in the government’s efforts to divest its stake in state-owned companies. He is expected to play a key role in identifying potential buyers, evaluating bids, and overseeing the privatisation process.

- Financial Markets: As SEBI chief, Pandey will be responsible for regulating the country’s financial markets, including the stock market, bond market, and commodity market. He is expected to bring his expertise in financial restructuring to the table, which will help in promoting financial stability and growth.

- Investor Protection: Pandey’s tenure as SEBI chief will also focus on investor protection, which is a critical area for the regulator. He is expected to take steps to improve investor awareness, reduce market volatility, and protect investors from fraudulent activities.

Conclusion

Tuhin Kanta Pandey’s appointment as the new SEBI chief is a significant development in the country’s financial landscape. With his expertise in disinvestment and financial restructuring, Pandey is expected to play a crucial role in shaping the country’s financial markets. His achievements as DIPAM Secretary, including the successful sale of Air India to the Tata Group and LIC’s biggest-ever market debut, are a testament to his ability to drive complex deals forward.

As SEBI chief, Pandey is expected to bring his expertise to the table, which will help in promoting financial stability, growth, and investor protection. The country can expect significant reforms and initiatives from Pandey, which will have a lasting impact on the financial landscape.

Source: