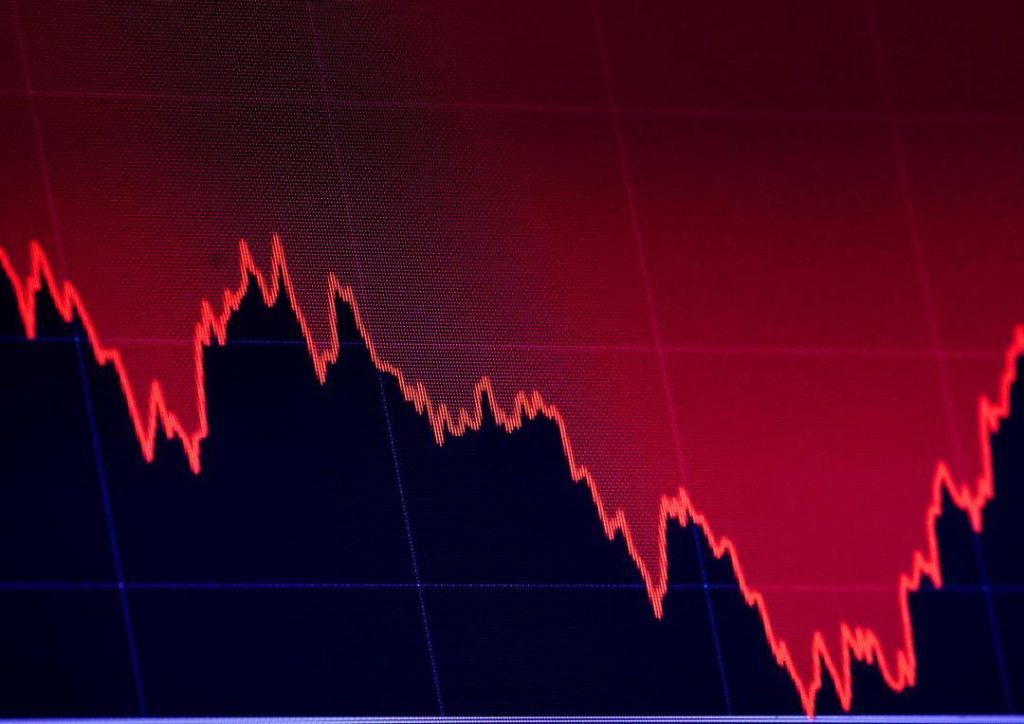

Bloodbath in US Markets: S&P 500 and Nasdaq at Over 6-Month Lows

The US stock market has been experiencing a tumultuous week, with the S&P 500 and Nasdaq indexes plummeting to over six-month lows on Monday. The sharp decline in the indices was fueled by concerns over the potential impact of tariffs on the economy and the likelihood of a recession.

As of 09:44 am (US time), the S&P 500 was down 81.90 points (1.47%) to 5,499.04, while the Nasdaq was down 409.48 points (2.36%) to 16,913.52. The massive selloff was driven by investors’ fears over US President Donald Trump’s upcoming announcement of tariff plans.

The news sent shockwaves through the markets, causing stocks to plummet. The Dow Jones Industrial Average was down 455.14 points (1.44%) to 25,444.41, while the Russell 2000 index of small-cap stocks fell 34.14 points (1.56%) to 2,144.15.

The selloff was widespread, with all 11 major sectors of the S&P 500 index experiencing losses. Technology stocks were among the hardest hit, with the Nasdaq-100 index falling 2.39% to 12,342.50. The index of tech giants, including Microsoft, Amazon, and Alphabet, was down 2.13% to 3,144.50.

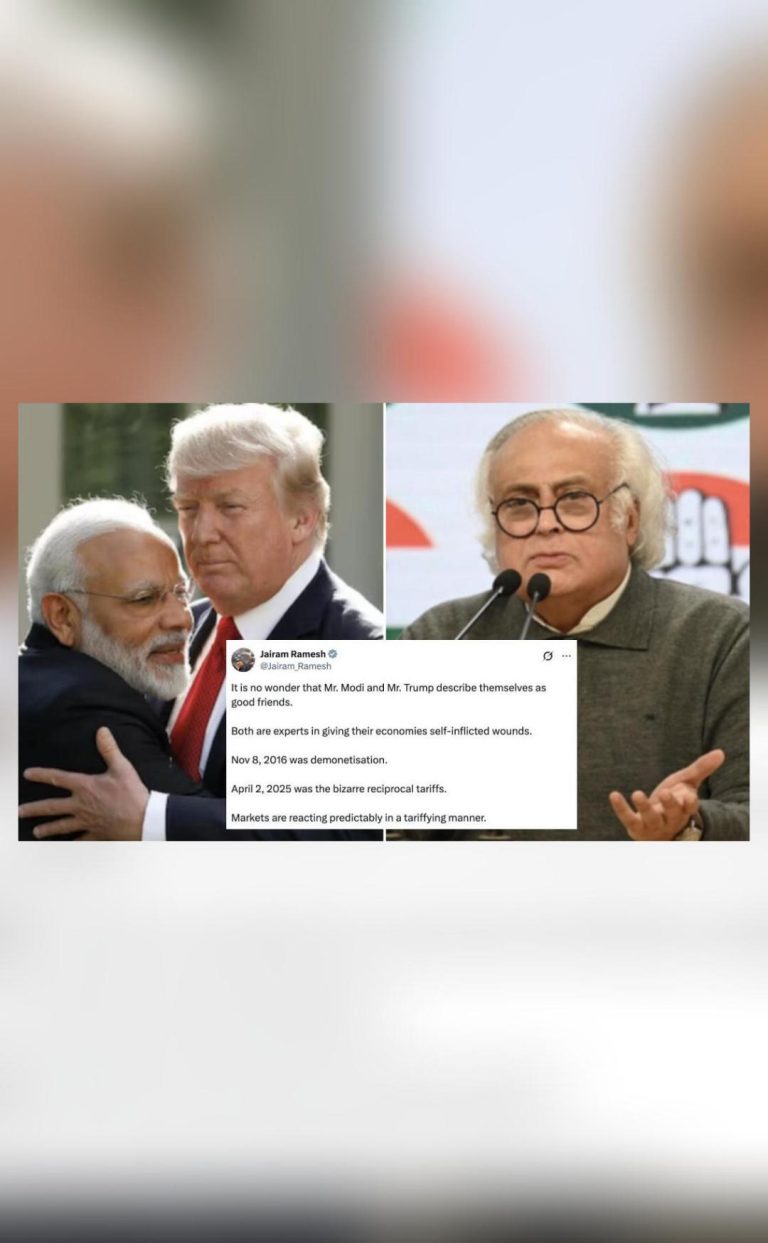

The sharp decline in the markets was attributed to the uncertainty surrounding President Trump’s tariff plans. Investors are worried that the tariffs could lead to a trade war, which could damage the economy and lead to a recession.

The tariffs are part of the President’s plan to protect American industries, particularly the steel and aluminum industries. However, the plan has been met with resistance from other nations, including China, which has threatened to retaliate with its own tariffs.

The news has sent a chill through the financial markets, with investors rushing to sell their stocks. The selloff was so severe that it even prompted the New York Federal Reserve to inject liquidity into the markets to prevent a complete collapse.

The decline in the markets has also had a significant impact on the broader economy. The yield on the 10-year US Treasury note fell to 2.44%, while the yield on the 30-year Treasury bond fell to 2.96%. The decline in yields is a sign of increased risk aversion, as investors seek safer assets.

The bloodbath in the US markets is a reminder of the volatility of the financial markets. Even the largest and most stable companies can experience significant declines in their stock prices, and investors must be prepared for the unexpected.

In conclusion, the recent decline in the S&P 500 and Nasdaq indexes is a sign of the uncertainty and volatility of the financial markets. Investors must be prepared for the unexpected and take steps to protect their investments.

Source:

https://www.reuters.com/markets/us/futures-tumble-tariffs-fuel-recession-worries-2025-03-31/