Chances of US recession raised to 45% by Goldman Sachs

The US economy is on shaky ground, with the chances of a recession increasing significantly, according to a recent report by Goldman Sachs. The investment bank has raised the odds of a US recession to 45% in the next 12 months, up from 35% just last month. This news comes as markets are gripped with fear over the ongoing trade war, sparked by US President Donald Trump’s tariffs.

The escalation of the trade war has already had a significant impact on the global economy, with many experts warning of a potential recession. Just last month, JP Morgan put the odds of a US and global recession at a staggering 60%. With the global economy already showing signs of slowing down, the increasing likelihood of a recession is causing widespread concern.

So, what are the main factors contributing to Goldman Sachs’ raised odds of a recession? And what does this mean for investors and the global economy?

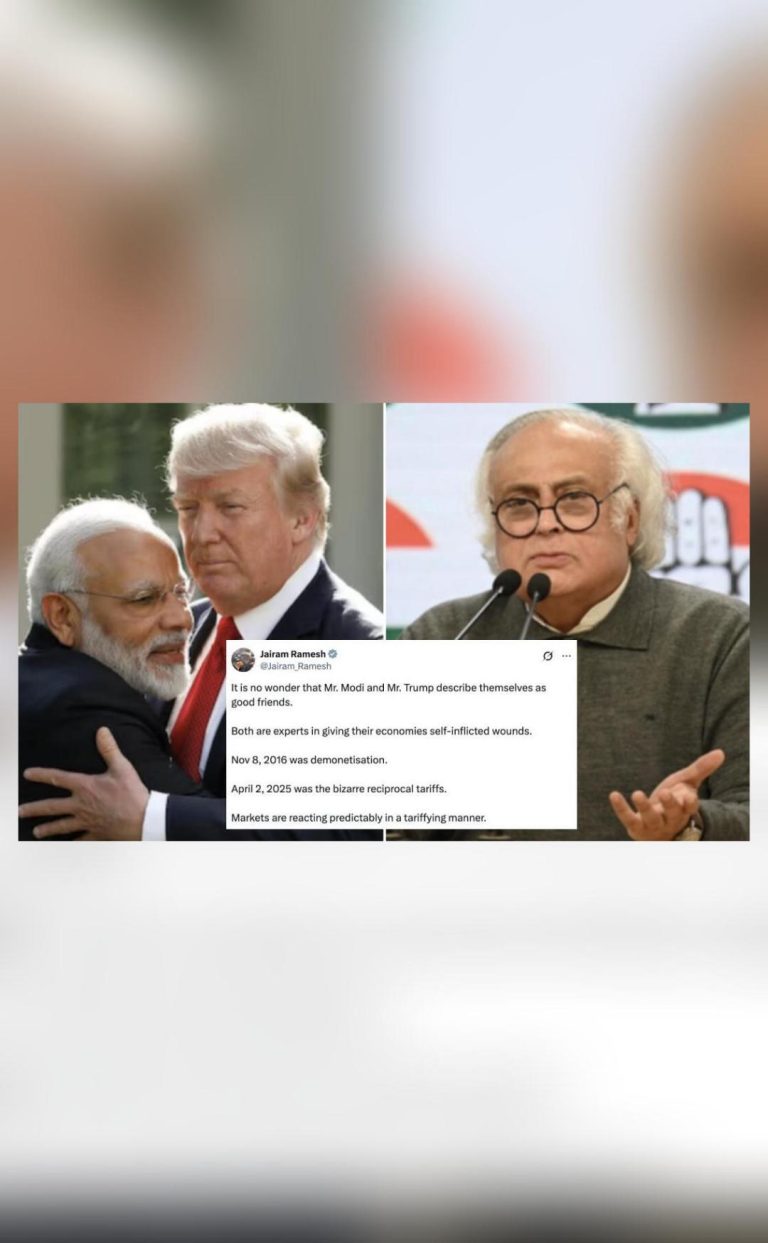

The Trade War

The ongoing trade war between the US and China is one of the main drivers of the increased likelihood of a recession. The tariffs imposed by President Trump have already led to a significant decline in US-China trade, with many businesses feeling the pinch. The trade war has also sparked a retaliatory response from China, which has led to a wider trade dispute between the two nations.

The trade war has already had a significant impact on the global economy, with many businesses struggling to cope with the uncertainty. The International Monetary Fund (IMF) has warned that the trade war could lead to a global recession, and many experts agree.

Other Factors Contributing to the Increased Likelihood of a Recession

In addition to the trade war, there are several other factors contributing to the increased likelihood of a recession. One of the main factors is the slowing down of the global economy. The global economy has been growing at a slower rate than expected, with many experts warning of a potential slowdown.

Another factor is the high level of debt in the global economy. Many countries, including the US, have high levels of debt, which can make it difficult for them to respond to economic shocks. The high level of debt also means that there is less room for central banks to cut interest rates, which could exacerbate the impact of a recession.

What Does this Mean for Investors and the Global Economy?

The increasing likelihood of a recession has significant implications for investors and the global economy. For investors, it means that it is essential to diversify their portfolios and consider alternative investments, such as gold or real estate. It also means that it is essential to keep a close eye on the global economy and be prepared to adjust their investment strategy as needed.

For the global economy, the increasing likelihood of a recession means that it is essential to take action to mitigate the impact. This could include implementing policies to stimulate economic growth, such as cutting interest rates or increasing government spending. It also means that it is essential to address the underlying issues driving the trade war, such as the high level of debt and the slowing down of the global economy.

Conclusion

The increasing likelihood of a recession is a significant concern for investors and the global economy. The trade war and other factors, such as the slowing down of the global economy and high levels of debt, are all contributing to the increased likelihood of a recession. To mitigate the impact of a recession, it is essential to take action to stimulate economic growth and address the underlying issues driving the trade war.

Source

Goldman Sachs raises odds of US recession to 45% (2025-04-07) – https://www.reuters.com/markets/us/goldman-sachs-raises-odds-us-recession-45-2025-04-07/