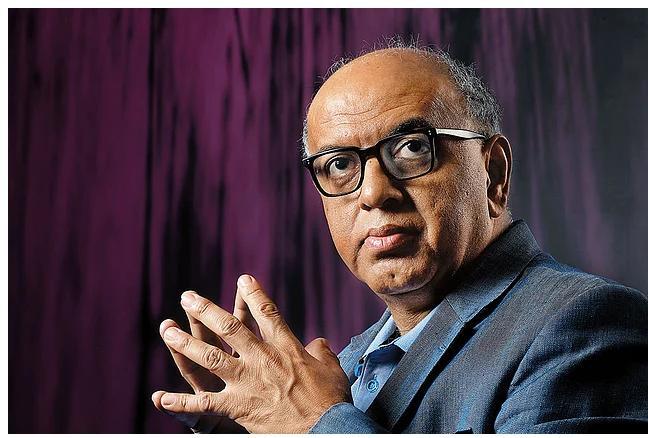

Domestic Investors to Shape India’s Future, Not FIIs: Goyal

In a recent statement, Union Minister of Commerce and Industry, Piyush Goyal, emphasized the importance of domestic investors in shaping India’s future, rather than relying on foreign institutional investors (FIIs). Goyal’s remarks come at a time when the Indian economy is facing various challenges, including market volatility and concerns over the impact of FIIs on the domestic market.

Goyal’s statement was made during an event, where he urged the industry to prioritize the welfare of small investors and work towards minimizing market volatility. He also highlighted the significant growth of the mutual funds industry in India, with assets under management (AUM) nearing ₹70 lakh crore and expected to reach ₹100 lakh crore soon.

The Minister’s comments have sparked a discussion on the role of FIIs in the Indian economy and their impact on the domestic market. While FIIs have been a major source of foreign capital for India, their involvement in the market has also been linked to market volatility and frequent changes in the rupee’s value.

In recent years, FIIs have been a major driver of market fluctuations in India. Their buying and selling activities have had a significant impact on the overall direction of the market, often leading to sudden and sharp changes in stock prices. This has made it challenging for small investors to make informed investment decisions, as the market can be highly unpredictable.

On the other hand, domestic investors, including retail and institutional investors, have been more stable and less prone to sudden changes in their investment decisions. They have a deeper understanding of the Indian market and are more likely to take a long-term view when making investment decisions.

Goyal’s statement is significant, as it highlights the importance of building a robust domestic investor base in India. This is particularly critical, as the country is likely to face challenges in the coming years, including a potential slowdown in economic growth and increased competition from other emerging markets.

The growth of the mutual funds industry in India is a positive sign, as it indicates increased participation of domestic investors in the market. The industry’s AUM has grown significantly over the past few years, driven by increased investor confidence and the introduction of new investment products.

The growth of the mutual funds industry has also led to increased competition among asset management companies (AMCs), which has benefited investors by leading to better returns and increased transparency. The industry’s growth has also created new job opportunities and has contributed to the overall growth of the Indian economy.

However, despite the growth of the mutual funds industry, there are still concerns over the impact of FIIs on the domestic market. FIIs have been known to exit the market quickly in times of market volatility, leading to sharp changes in stock prices and increased uncertainty for investors.

Goyal’s statement is a recognition of the importance of building a robust domestic investor base in India. It is a call to action for the industry to prioritize the welfare of small investors and work towards minimizing market volatility.

In conclusion, Piyush Goyal’s statement is a significant development in the Indian economy, as it highlights the importance of domestic investors in shaping the country’s future. The growth of the mutual funds industry is a positive sign, and the industry’s continued growth and development will be critical in building a robust domestic investor base.