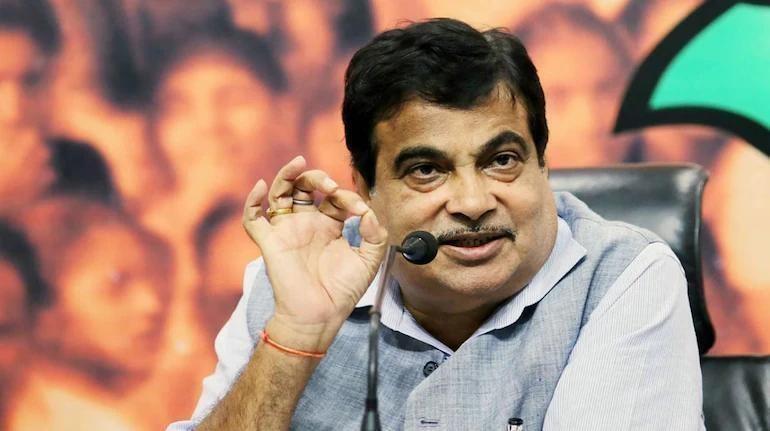

Don’t Ask for Tax Cuts, Govt Has Also Got Its Own Limits: Gadkari

The Indian government has been grappling with the issue of tax cuts for quite some time now, with various industries and sectors demanding a reduction in Goods and Services Tax (GST) and other taxes. However, Union Minister Nitin Gadkari has recently sparked a controversy by saying that the industry should not demand a reduction in taxes. According to him, the government needs funds to implement welfare schemes and the industry should focus on creating jobs and growing instead of asking for tax cuts.

Gadkari made these comments during an interview with a leading news channel, where he emphasized that the government has its own limitations and cannot reduce taxes indefinitely. He said, “Don’t ask for reducing…GST and taxes, it’s a continuous process which is going on. If we reduce…tax, you’ll ask for more, because this is human psychology.” He added, “The government has also got its own limits.”

Gadkari’s statement has sparked widespread debate and controversy, with many industry leaders and experts questioning his views. Some have argued that tax cuts are necessary to boost economic growth and create jobs, while others have pointed out that the government’s own fiscal discipline is essential to ensure the country’s economic stability.

The debate over tax cuts is not new to India. The GST, which was introduced in 2017, has been criticized for being too complex and for its negative impact on small and medium-sized enterprises (SMEs). The tax rate on goods and services was initially set at 28% for luxury items, 18% for most goods and services, and 12% for essential items. However, the government has since reduced the tax rates on several items, including essential goods and services.

Despite the controversy over tax cuts, Gadkari’s comments have also been seen as a warning to the industry to be more realistic and pragmatic in its demands. The government has been under pressure to reduce taxes as a way to boost economic growth and create jobs, but many experts argue that this approach is flawed.

For one, reducing taxes can lead to a reduction in government revenue, which can have negative consequences for the economy. Additionally, tax cuts can also benefit large corporations and wealthy individuals, rather than the poor and marginalized sections of society. Furthermore, the government’s own fiscal discipline is essential to ensure the country’s economic stability, and reducing taxes can compromise this discipline.

Gadkari’s comments have also been seen as a reminder of the importance of fiscal discipline and the need for the government to prioritize its spending. The Indian government has been under pressure to increase its spending on welfare schemes and social programs, but many experts argue that this approach is flawed. Instead, the government should focus on creating jobs and promoting economic growth, rather than relying on handouts and subsidies.

In conclusion, Gadkari’s comments are a reminder of the importance of fiscal discipline and the need for the government to prioritize its spending. While tax cuts may seem like a quick fix to boost economic growth, they can have negative consequences for the economy and society. Instead, the government should focus on creating jobs and promoting economic growth, rather than relying on handouts and subsidies.

It is also important to note that the government has its own limitations and cannot reduce taxes indefinitely. As Gadkari pointed out, the government has its own limits, and it needs to balance its spending with its revenue. The industry should also focus on creating jobs and growing instead of asking for tax cuts. By doing so, the government and the industry can work together to promote economic growth and create a more prosperous society.