List of India’s 10 Most Valued Private Companies Released, Reliance Tops

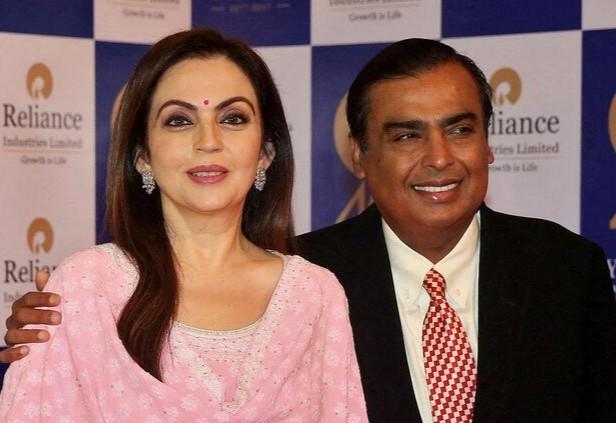

The 2024 list of India’s most valuable private companies has been released, and the results are no surprise. Mukesh Ambani’s Reliance Industries has topped the list with a staggering valuation of ₹17,52,650 crore. This is the second consecutive year that Reliance Industries has held the top spot, cementing its position as the most valuable private company in India.

The list, released by Hurun Research, a leading research firm, and Burgundy Private, a global wealth management company, ranks the top 500 private companies in India based on their market capitalization. The list also includes public companies that are privately held.

Reliance Industries, which has a market capitalization of over ₹17 lakh crore, is followed by Tata Consultancy Services (TCS), which has a valuation of ₹16,10,800 crore. HDFC Bank, with a valuation of ₹14,22,570 crore, takes the third spot, followed by Bharti Airtel, which has a valuation of ₹9,74,470 crore.

ICICI Bank, with a valuation of ₹9,30,720 crore, takes the fifth spot, while Infosys, with a valuation of ₹7,99,400 crore, takes the sixth spot. ITC, with a valuation of ₹5,80,670 crore, takes the seventh spot, while Larsen & Toubro (L&T), with a valuation of ₹5,42,770 crore, takes the eighth spot. HCLTech, with a valuation of ₹5,18,170 crore, takes the ninth spot, and the National Stock Exchange (NSE), with a valuation of ₹4,70,250 crore, takes the tenth spot.

The list also includes several other well-known companies, including Adani Group, Bajaj Finance, and Bajaj Finserv. These companies have all made significant strides in recent years, driven by their growth in revenue and profitability.

The release of the list comes as a significant boost to the Indian business community, which has been facing challenges in recent years. The COVID-19 pandemic has had a significant impact on the Indian economy, with many companies struggling to stay afloat.

However, the resilience of the Indian business community has been evident in the way that many companies have adapted to the new normal and continued to grow and thrive. The release of the list is a testament to this resilience and a reminder that India remains a significant player in the global economy.

The list also highlights the importance of diversification in the Indian business landscape. While Reliance Industries, TCS, and HDFC Bank are all dominant players in their respective industries, the list also includes companies from a range of sectors, including technology, finance, and manufacturing.

This diversification is a key driver of growth and innovation in the Indian economy, and it is likely to continue to play a significant role in the years to come.

In conclusion, the release of the list of India’s most valuable private companies is a significant event in the Indian business community. Reliance Industries’ top spot is a testament to the company’s growth and success over the years, and it is likely to continue to play a significant role in the Indian economy in the years to come.

The list also highlights the importance of diversification and innovation in the Indian business landscape, and it is likely to continue to drive growth and development in the years to come.