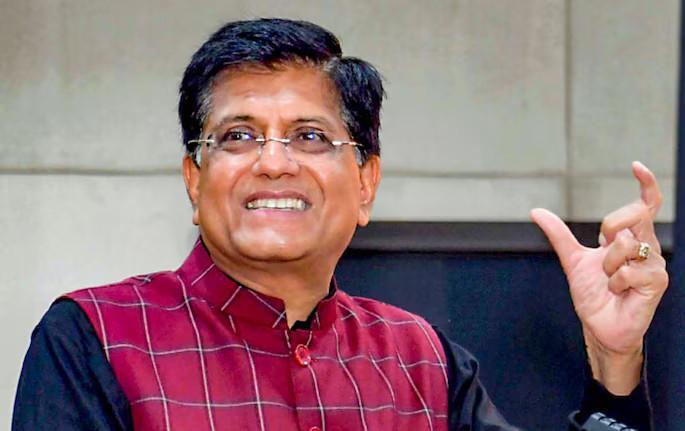

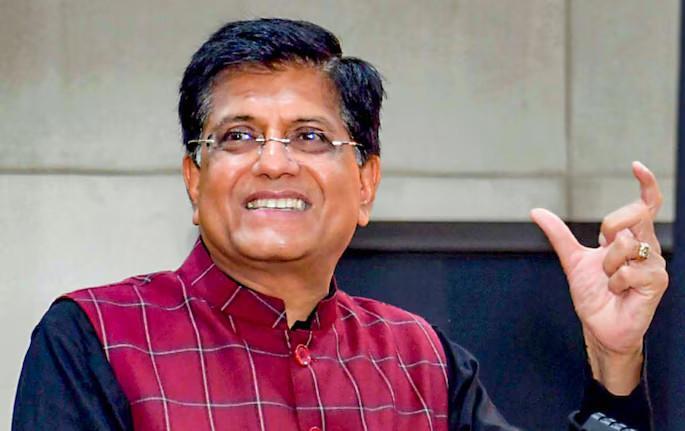

Move Abroad, Get ‘Uncaged’ Capital: Shankar to Young Investors

In a recent tweet, veteran investor Shankar Sharma has been making waves in the financial world with his unconventional advice to young investors. Sharma, a renowned name in the investment circles, has suggested that youngsters who want to become “a great investor” should consider moving abroad.

In his tweet, Sharma stated, “Move abroad. Get any job. Build knowledge on the side. In a few years, you will have knowledge and mobile, free-flowing uncaged USD capital.” He further added, “And then, magic will happen. You will glide in & out of markets, assets [and] currencies.”

At first glance, Sharma’s advice may seem counterintuitive, especially for those who are just starting their investment journey. However, as we dive deeper into the tweet, it becomes clear that Sharma is advocating for a strategic approach to investing, one that involves leveraging the benefits of international living and the global capital markets.

So, what exactly is Sharma suggesting, and how can young investors benefit from his advice? Let’s break it down.

The Benefits of Moving Abroad

Sharma’s first point is to “move abroad.” For many young investors, this may seem like a daunting task, but it’s essential to understand the benefits that come with living in a foreign country. Here are a few:

- Global Perspective: Living abroad exposes you to different cultures, markets, and ways of thinking. This can help broaden your perspective and provide a more nuanced understanding of the global economy.

- Networking Opportunities: Abroad, you’ll have the chance to connect with people from diverse backgrounds, industries, and professions. This can lead to valuable networking opportunities and potential collaborations.

- Access to Global Markets: As a resident of a foreign country, you’ll have access to a broader range of financial markets, assets, and currencies. This can provide more investment options and greater flexibility.

Building Knowledge on the Side

Sharma’s second point is to “build knowledge on the side.” This is crucial because, in today’s fast-paced financial world, staying informed and up-to-date is essential. Here are a few ways to build your knowledge:

- Online Courses: Take online courses or MOOCs (Massive Open Online Courses) to learn about investing, finance, and economics.

- Books and Podcasts: Stay current with financial literature and podcasts, which can provide valuable insights and perspectives.

- Networking: Attend conferences, seminars, and networking events to connect with experienced investors and thought leaders.

Gaining ‘Uncaged’ Capital

Sharma’s third point is to “gain knowledge and mobile, free-flowing uncaged USD capital.” What does this mean, exactly? In today’s digital age, financial borders are becoming increasingly irrelevant. With the right tools and strategies, you can access and manage your funds from anywhere in the world.

Uncaged Capital: Uncaged capital refers to the freedom to move your money across borders, into different assets, and currencies, without being restricted by geographical or regulatory constraints. This allows you to take advantage of global investment opportunities and adapt to changing market conditions.

Gaining Flexibility

With uncaged capital, you’ll gain the flexibility to:

- Diversify Your Portfolio: Invest in a range of assets, such as stocks, bonds, real estate, and cryptocurrencies, across different markets and currencies.

- Take Advantage of Market Volatility: Quickly respond to market fluctuations by buying or selling assets as needed.

- Manage Risk: Spread your risk by investing in multiple assets and currencies, reducing your exposure to any one particular market or sector.

Conclusion

Shankar Sharma’s advice may seem unconventional, but it’s rooted in his extensive experience and understanding of the global financial landscape. By moving abroad, building knowledge on the side, and gaining uncaged capital, young investors can gain a competitive edge in the world of finance.

In today’s interconnected world, it’s more important than ever to be adaptable, informed, and proactive. By following Sharma’s advice, you can unlock new opportunities, build a successful investment portfolio, and achieve your financial goals.

Source: