REC Targets ₹50,000 Crore Loan Book for Nuclear Power by 2030

The Indian power sector is witnessing a significant transformation, with a growing focus on renewable energy sources to reduce carbon footprint and ensure sustainable development. In this context, REC Limited, a leading financial institution, has set its sights on financing nuclear power projects worth ₹50,000 crore by 2030. The company aims to achieve this ambitious target by sanctioning ₹15,000 crore annually for nuclear projects starting from 2026.

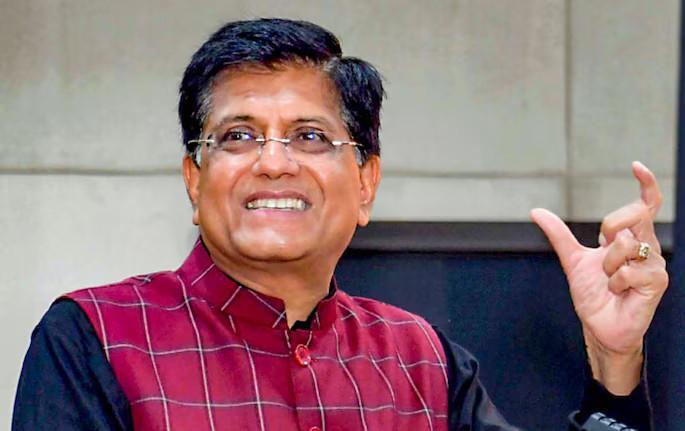

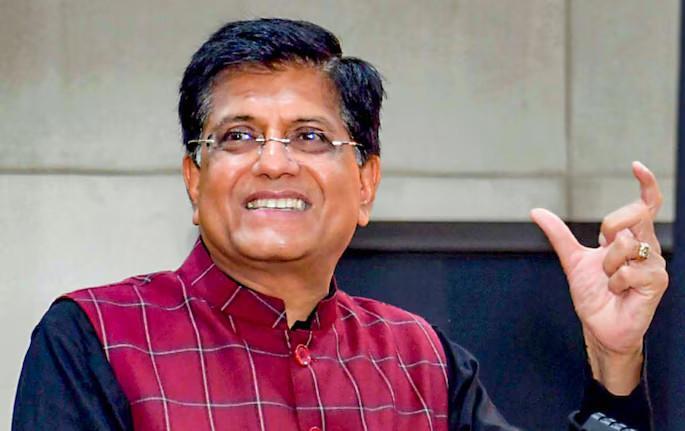

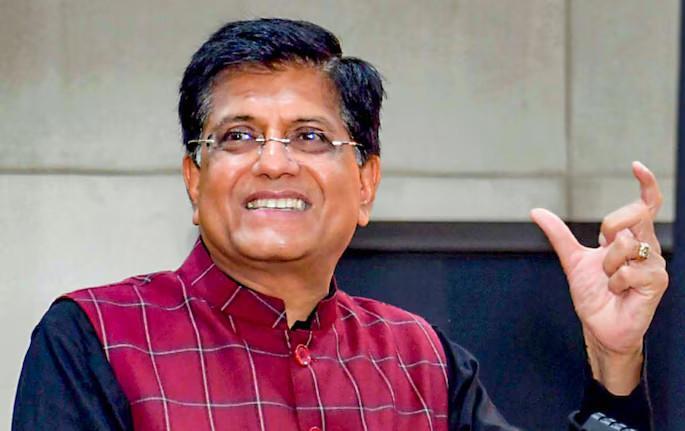

The announcement was made by Vivek Kumar Dewangan, Chairman of REC Limited, who emphasized the company’s commitment to supporting the growth of nuclear power in India. Dewangan highlighted the cost-effectiveness of nuclear power, stating that it costs approximately ₹14 crore to generate 1MW of nuclear power. This underscores the potential of nuclear power to provide a reliable and clean source of energy for the country’s growing economy.

REC Limited’s ambitious target is part of its broader strategy to expand its loan book and grow its assets under management (AUM). The company aims to achieve a total AUM of ₹10 lakh crore by 2028-29, marking a significant increase from its current AUM of around ₹4.5 lakh crore. Furthermore, REC has set a goal of achieving zero net non-performing assets (NPAs) by 2025, demonstrating its commitment to maintaining a healthy and sustainable business model.

The nuclear power sector has been gaining momentum in India in recent years, with the government’s efforts to increase the share of non-fossil fuels in the country’s energy mix. The sector has the potential to play a crucial role in reducing India’s carbon footprint and meeting its commitment to the Paris Agreement. REC’s decision to focus on financing nuclear power projects is therefore a strategic move to support the growth of the sector and contribute to the country’s sustainable development goals.

The Indian nuclear power industry has made significant progress in recent years, with the commissioning of new reactors and the expansion of existing facilities. The sector has also seen an increase in private sector participation, with companies like NPCIL and Larsen & Toubro (L&T) investing heavily in nuclear power infrastructure.

REC Limited’s decision to focus on financing nuclear power projects is likely to have a positive impact on the sector. The company’s sanctioning of ₹15,000 crore annually for nuclear projects starting from 2026 is expected to provide a significant boost to the sector, enabling the development of new projects and the expansion of existing facilities.

In addition to its focus on nuclear power, REC Limited is also supporting the growth of other renewable energy sources, including solar and wind power. The company has sanctioned loans worth ₹15,000 crore for renewable energy projects in the current financial year, demonstrating its commitment to supporting the growth of the renewable energy sector.

In conclusion, REC Limited’s decision to target a ₹50,000 crore loan book for nuclear power by 2030 is a significant development for the Indian power sector. The company’s commitment to supporting the growth of nuclear power is likely to have a positive impact on the sector, enabling the development of new projects and the expansion of existing facilities. As the country continues to focus on reducing its carbon footprint and meeting its sustainable development goals, REC Limited’s decision to prioritize nuclear power is a strategic move that is likely to contribute to the growth of the sector.