Farmer gets ₹30 crore income tax notice in Mathura, says ‘PAN card was misused’

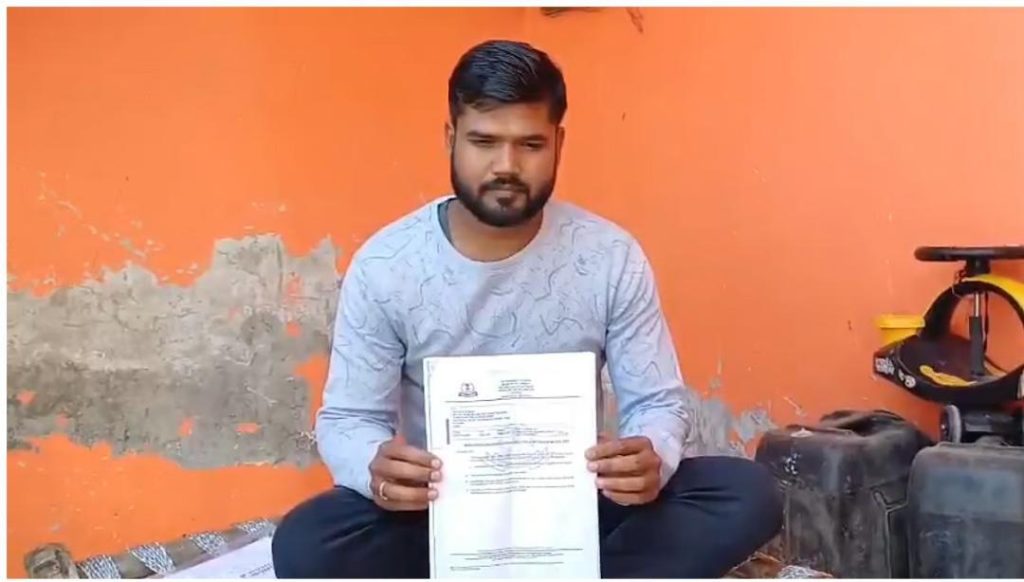

A shocking incident has come to light in Mathura, Uttar Pradesh, where a poor farmer has received a massive income tax notice of ₹30 crore from the Income Tax Department. The farmer, Saurabh Kumar, has alleged that his PAN card was misused to create fake GST numbers and companies, leading to the astronomical tax demand.

This is not an isolated incident, as we have seen in the past, where innocent individuals have been caught in the crossfire of tax authorities’ efforts to crack down on tax evasion. Just last year, a juice seller in Delhi received a ₹7.79 crore income tax notice, highlighting the need for a more targeted approach to tax collection.

Saurabh Kumar, a 35-year-old farmer from Mathura, has been left reeling by the sudden tax demand. He claims that he has never earned more than ₹5 lakh in a year and has always filed his tax returns honestly. In a shocking twist, Kumar has alleged that his PAN card was misused to create fake GST numbers and companies, leading to the massive tax demand.

“I am in shock,” Kumar told a local newspaper. “I have never earned such a huge amount. I have always filed my tax returns on time and honestly. But now, I have received a notice for ₹30 crore. I don’t know how this happened or who is behind it.”

Kumar has filed a complaint with the police and is seeking their help to investigate the matter. He has also approached the Income Tax Department to explain the situation and request a reduction in the tax demand. However, the tax authorities have so far refused to budge, citing a thorough investigation and a ” prima facie case” against Kumar.

The incident has raised questions about the security and misuse of PAN cards, which are used to track an individual’s financial transactions. With millions of PAN cards issued in the country, the risk of misuse is high, and incidents like this highlight the need for better security measures to prevent fraud.

The case also raises concerns about the impact of such massive tax demands on innocent individuals. Kumar’s family is struggling to make ends meet, and the tax notice has put a significant strain on their finances. “We are living in a state of uncertainty,” Kumar’s wife said. “We don’t know how we will pay such a huge amount. We are just simple farmers, we don’t have that kind of money.”

The incident has also sparked a debate about the effectiveness of the Income Tax Department’s methods in collecting taxes. While the department’s efforts to crack down on tax evasion are commendable, incidents like this highlight the need for a more targeted approach to tax collection. The department needs to ensure that it is not unfairly targeting innocent individuals and that its methods are not causing undue hardship.

In conclusion, the case of Saurabh Kumar serves as a stark reminder of the need for better security measures to prevent misuse of PAN cards and the importance of targeted tax collection. The Income Tax Department needs to take a closer look at the incident and ensure that it is not unfairly targeting innocent individuals. The government also needs to review its tax laws and ensure that they are fair and just.