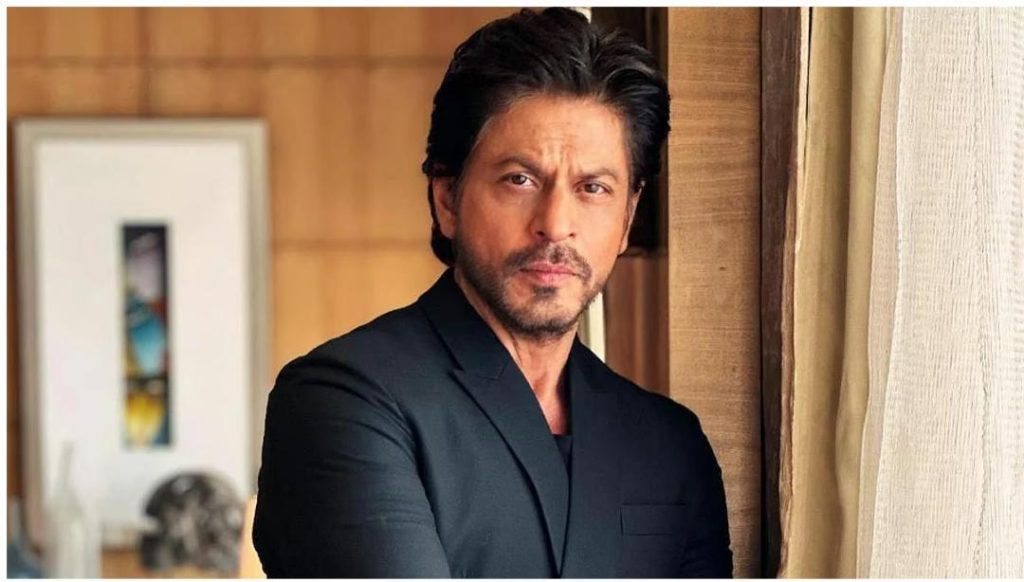

Shah Rukh Khan Wins Tax Dispute Case

In a major relief to the King of Bollywood, Shah Rukh Khan, the Income Tax Appellate Tribunal (ITAT) has quashed a reassessment order issued against him for allegedly not paying taxes on his remuneration for the film ‘Ra.One’. The case pertains to Assessment Year 2012-13 when Shah Rukh Khan showed an income of ₹83.42 crore. The tax officer had reassessed the actor’s income at ₹84.17 crore, which the bench said wasn’t legally justified.

According to the reports, the reassessment order was issued by the tax officer in 2019, claiming that Shah Rukh Khan had not paid taxes on his remuneration for the film ‘Ra.One’, which was released in 2011. The tax officer had allegedly discovered that the actor had received a remuneration of ₹55 crore for the film, but had not paid taxes on it.

However, Shah Rukh Khan’s team had contested the reassessment order, claiming that it was based on incorrect assumptions and was not legally justified. The ITAT bench, comprising Justice Chanderdeep Singh and Justice Kuldip Singh, has now accepted Shah Rukh Khan’s arguments and quashed the reassessment order.

The ITAT bench observed that the tax officer had not followed the due process of law while issuing the reassessment order. The bench also noted that the tax officer had not provided any sufficient evidence to justify the reassessment of Shah Rukh Khan’s income.

Shah Rukh Khan’s team had argued that the actor had already paid taxes on his income from ‘Ra.One’ and that the reassessment order was an attempt to reopen an already settled matter. The ITAT bench has now accepted this argument and ruled in favour of Shah Rukh Khan.

This is a significant relief for Shah Rukh Khan, who has been facing tax disputes in the past. In 2019, the actor had also won a tax dispute case against the Income Tax Department over his income from his production company, Red Chillies Entertainment.

The ITAT order is a major victory for Shah Rukh Khan, and it sets a precedent for other celebrities who may be facing similar tax disputes. The order also highlights the importance of following the due process of law while issuing reassessment orders, and the need for tax authorities to provide sufficient evidence to justify their actions.

In recent years, there have been several high-profile tax disputes in the entertainment industry. Many celebrities have been slapped with reassessment orders and tax notices, which have led to a lot of uncertainty and anxiety. The ITAT order in Shah Rukh Khan’s case is a welcome relief for the industry, and it sets a positive precedent for the resolution of tax disputes.

The ITAT order is also a tribute to the judicial system, which has shown that it is willing to stand up for the rights of individuals and companies, even in the face of powerful tax authorities. The order is a reminder that the judicial system is designed to ensure that justice is served, and that the rights of individuals are protected.

In conclusion, the ITAT order in Shah Rukh Khan’s case is a significant relief for the actor and his team. The order highlights the importance of following the due process of law while issuing reassessment orders, and the need for tax authorities to provide sufficient evidence to justify their actions. The order also sets a precedent for the resolution of tax disputes in the entertainment industry, and it is a tribute to the judicial system’s commitment to upholding the rule of law.

Source: