Our Job to Find & Punish Them: SEBI on BluSmart Partner Gensol’s Fraud

In a recent development, the Securities and Exchange Board of India (SEBI) has taken strong action against Gensol Engineering, a partner of BluSmart, a company that offers electric vehicles (EVs) on rent. SEBI has barred Gensol and its promoters, brothers Anmol and Puneet Singh Jaggi, from the securities market. The brothers were accused of diverting company funds for personal use, a grave violation of securities laws.

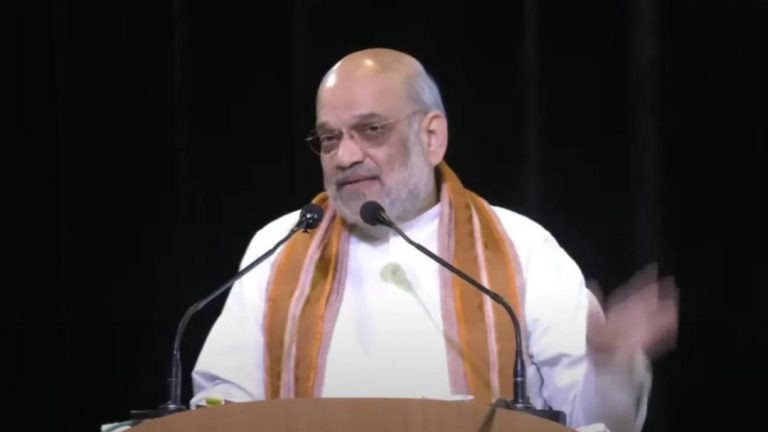

In a statement, SEBI Chief Tuhin Kanta Pandey said, “There will be companies like Gensol in the system; SEBI’s job is to find and punish them.” This statement highlights the regulator’s commitment to maintaining market integrity and protecting investors from fraudulent activities.

Gensol Engineering, which is a partner of BluSmart, was alleged to have indulged in financial irregularities, including misappropriation of funds. SEBI’s investigation revealed that the brothers had diverted company funds for personal use, which is a serious violation of securities laws.

The SEBI chief’s statement sends a strong message to companies and individuals who engage in fraudulent activities. It emphasizes that SEBI will leave no stone unturned in its efforts to uncover and punish such companies. The regulator’s actions demonstrate its commitment to maintaining a fair and transparent market, where investors can trust that their investments are safe and secure.

The case against Gensol and BluSmart promoters is significant not only because of the financial irregularities but also because of the impact it could have on the wider electric vehicle industry. BluSmart, which is a promising company in the EV space, has partnered with several companies, including Gensol, to offer electric vehicles on rent. However, the alleged fraud committed by Gensol raises questions about the company’s integrity and its ability to operate a successful business.

The case also highlights the importance of corporate governance and accountability. Companies must ensure that they have robust internal controls in place to prevent financial irregularities and ensure that funds are used for legitimate business purposes. The SEBI chief’s statement emphasizes the need for companies to demonstrate transparency and accountability in their operations.

Moreover, the case underscores the need for regulators to be vigilant and proactive in their efforts to uncover and punish fraudulent activities. SEBI’s actions demonstrate its commitment to protecting investors and maintaining market integrity. The regulator’s ability to detect and prevent fraudulent activities is crucial in maintaining investor confidence and ensuring the stability of the financial system.

The SEBI chief’s statement also raises questions about the role of companies like BluSmart in the wider electric vehicle industry. As the industry continues to grow and evolve, companies must ensure that they operate with integrity and transparency. The alleged fraud committed by Gensol Engineering highlights the need for companies to prioritize corporate governance and accountability.

In conclusion, the SEBI chief’s statement emphasizes the regulator’s commitment to finding and punishing companies that engage in fraudulent activities. The case against Gensol Engineering and BluSmart promoters is significant not only because of the financial irregularities but also because of the impact it could have on the wider electric vehicle industry. Companies must ensure that they operate with integrity and transparency, and regulators must be vigilant and proactive in their efforts to uncover and punish fraudulent activities.

Source: