Our Job to Find & Punish Them: SEBI on BluSmart Partner Gensol’s Fraud

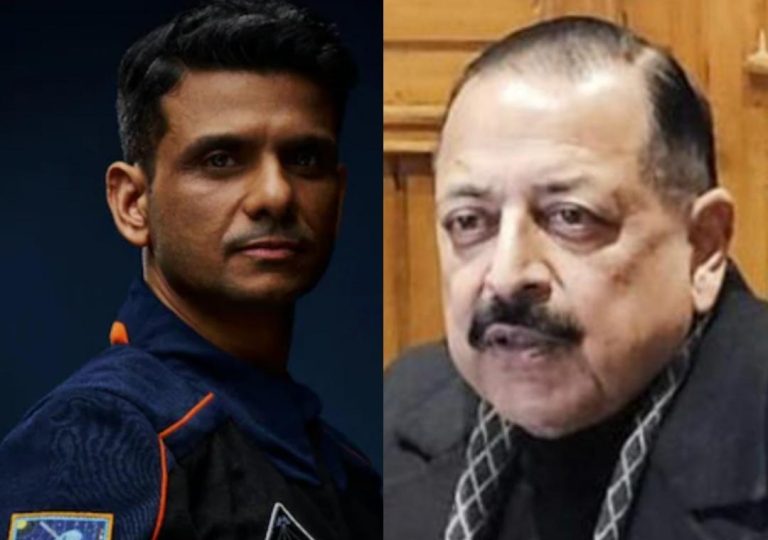

The Securities and Exchange Board of India (SEBI) has been cracking down on financial irregularities in the country, and its latest move is a stern warning to errant companies and promoters. Reacting to SEBI’s uncovering of financial irregularities at BluSmart partner Gensol Engineering, SEBI Chief Tuhin Kanta Pandey said, “There will be companies like Gensol in the system; SEBI’s job is to find and punish them.”

The harsh words come after SEBI barred Gensol and BluSmart promoters, brothers Anmol and Puneet Singh Jaggi, from the securities market. The brothers, who are also directors of Gensol, were accused of diverting company funds for personal use. SEBI’s findings revealed that the brothers had misused the funds for their own benefit, violating the norms set by the regulatory body.

The fraud was uncovered by SEBI’s investigation, which found that the brothers had indulged in unauthorized transactions, siphoning off funds meant for the company’s operations. The brothers had also failed to disclose their personal financial interests, which is a violation of SEBI’s regulations.

SEBI’s action against Gensol and the Jaggi brothers is a significant step towards ensuring the integrity of the Indian capital market. The regulatory body has been working tirelessly to protect the interests of investors and ensure that the market is free from fraud and malpractices.

The SEBI Chief’s statement sends a clear message to companies and promoters that SEBI will not tolerate any form of financial irregularity. The regulatory body has a zero-tolerance policy towards fraud, and those who violate the norms will be dealt with severely.

The Gensol case is just the latest in a series of crackdowns by SEBI on companies and promoters who have indulged in financial irregularities. In recent months, SEBI has barred several companies and promoters from the securities market for violating the norms set by the regulatory body.

SEBI’s actions are a step towards ensuring that the Indian capital market is a level playing field for all investors. The regulatory body is committed to protecting the interests of investors and ensuring that the market is free from fraud and malpractices.

The Gensol case also highlights the importance of corporate governance and the need for companies to maintain transparency and accountability. Companies must ensure that their financial dealings are above board and that they comply with the norms set by SEBI.

In conclusion, SEBI’s action against Gensol and the Jaggi brothers is a significant step towards ensuring the integrity of the Indian capital market. The regulatory body’s commitment to finding and punishing those who indulge in financial irregularities is a reassuring message to investors and companies alike.

As SEBI Chief Tuhin Kanta Pandey said, “There will be companies like Gensol in the system; SEBI’s job is to find and punish them.” SEBI’s actions are a testament to its commitment to protecting the interests of investors and ensuring that the market is free from fraud and malpractices.