Why did Sensex crash over 2,200 points on Monday?

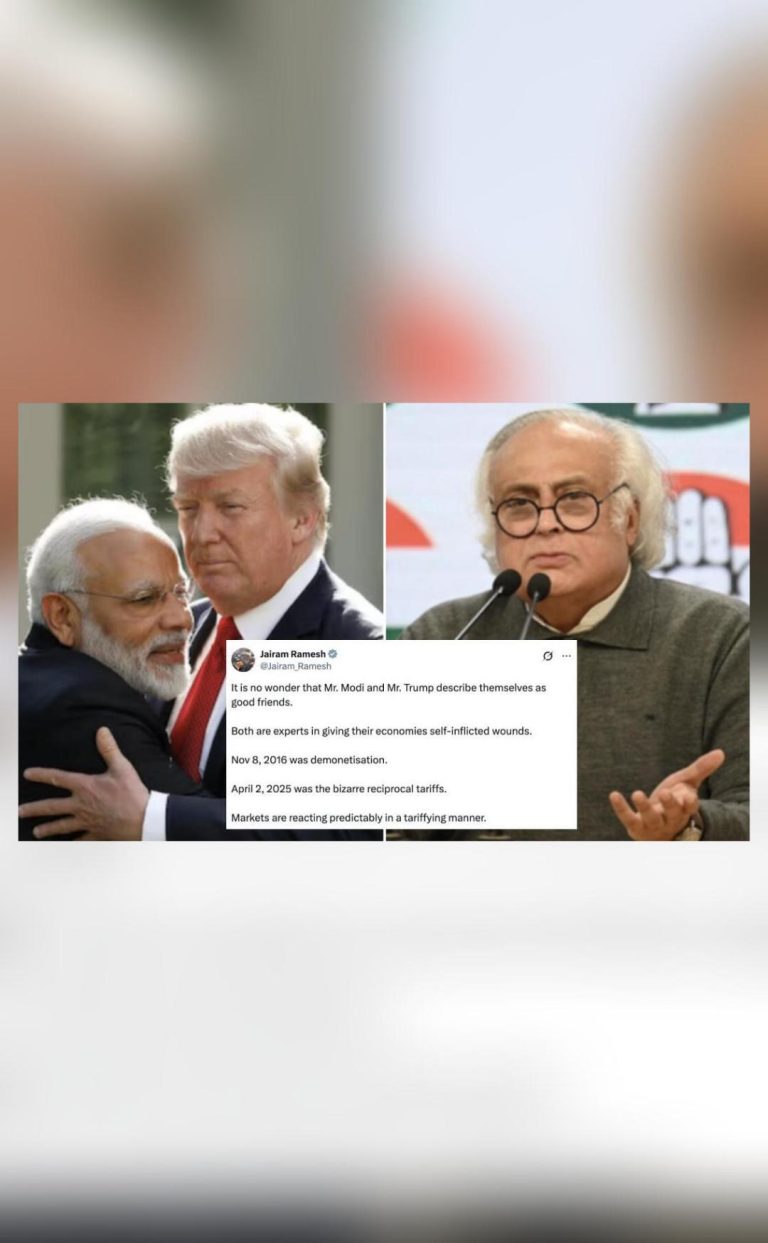

Monday was a tumultuous day for the Indian stock market, with the Sensex crashing by over 2,200 points, its biggest single-day drop since August 2015. The market rout was triggered by growing fears of a global trade war after US President Donald Trump announced tariffs on several countries. The Sensex and Nifty crash was preceded by a market rout on Wall Street and other major Asian markets like Japan, Singapore, and China. Foreign portfolio investors (FPIs) have also resumed selling Indian equities again.

The Indian stock market has been on a volatile ride in recent times, with the Sensex and Nifty indices witnessing sharp fluctuations in recent weeks. However, Monday’s crash was unprecedented, with the Sensex plummeting by 2,213.33 points, or 4.73%, to close at 38,016.19. The Nifty 50 index also tanked by 678.25 points, or 5.71%, to settle at 11,268.20.

So, what triggered this market crash? Let’s take a closer look.

Global Trade Worries

The primary reason behind the Sensex crash was the growing uncertainty over a global trade war. Last Friday, US President Donald Trump announced tariffs on $200 billion worth of Chinese goods, which sparked fears of a trade war between the two economic superpowers. This move was seen as a major escalation in the ongoing trade tensions between the US and China.

The tariffs imposed by the US would affect a wide range of Chinese goods, including electronics, textiles, and plastics. China, in turn, has threatened to impose retaliatory tariffs on $60 billion worth of US goods, including soybeans, corn, and aircraft. This escalating trade tension has raised concerns about the potential impact on global trade, economic growth, and investor sentiment.

Market Reaction

The global market reaction to the US-China trade tensions was swift and severe. On Friday, the US stock market witnessed its worst day since January, with the Dow Jones Industrial Average plummeting by over 800 points. The S&P 500 index also fell by 3.1%, while the Nasdaq composite dropped by 3.7%.

In Asia, other major markets like Japan, Singapore, and China also witnessed sharp losses on Monday. The Nikkei 225 index in Japan fell by 4.5%, while the Singapore’s Straits Times Index dropped by 3.4%. In China, the Shanghai Composite Index plummeted by 5.7%.

Impact on Indian Markets

The Indian stock market, which has been heavily reliant on foreign capital, was not immune to the global market turmoil. The Sensex and Nifty indices had already been under pressure in recent weeks due to concerns over the impact of the US-China trade tensions on Indian exports and economic growth.

The Indian market also witnessed a sharp sell-off in foreign portfolio investment (FPI) in recent weeks, with FPIs selling Indian equities worth over ₹14,000 crore in August. This sudden outflow of foreign capital has put pressure on the Indian rupee, which has depreciated by over 10% in recent months.

Why did Sensex crash over 2,200 points on Monday?

So, why did the Sensex crash over 2,200 points on Monday? In addition to the global trade tensions, there are several other factors that contributed to the market crash.

- Global Market Rout: The global market rout, sparked by the US-China trade tensions, had a direct impact on Indian markets. The Sensex and Nifty indices are heavily influenced by global market trends, and a sharp decline in global markets would naturally lead to a decline in Indian markets.

- FPI Selling: The sudden outflow of foreign portfolio investment (FPI) had already put pressure on the Indian rupee and the stock market. The FPI selling intensified on Monday, leading to a sharp decline in the Sensex and Nifty indices.

- Indian Economy: The Indian economy has been facing several challenges, including a decline in global trade, a sharp depreciation of the rupee, and a decline in consumer spending. The global trade tensions have only added to these challenges, leading to a decline in investor sentiment.

- Valuation: The Indian market had been overvalued for some time, with valuations at historic highs. The market crash on Monday was seen as a correction of sorts, with investors taking profits and selling their stocks.

Conclusion

The Sensex crash on Monday was a wake-up call for Indian investors, highlighting the risks and uncertainties in the global economy. The Indian market is heavily influenced by global market trends, and a decline in global markets would naturally lead to a decline in Indian markets.

While the market crash was unprecedented, it also presents an opportunity for long-term investors to buy quality stocks at discounted prices. However, investors should exercise caution and do their due diligence before making any investment decisions.

Source: